Appendix A: K-Means customer segmentation case study#

import os

import random

import sys

import time

import numpy as np

import pandas as pd

sys.path.append("code/.")

import matplotlib.pyplot as plt

import seaborn as sns

from plotting_functions import *

from sklearn import cluster, datasets, metrics

from sklearn.compose import ColumnTransformer, make_column_transformer

from sklearn.datasets import make_blobs

from sklearn.decomposition import PCA

from sklearn.pipeline import Pipeline, make_pipeline

from sklearn.preprocessing import StandardScaler

# from support_functions import *

from yellowbrick.cluster import KElbowVisualizer, SilhouetteVisualizer

#plt.style.use("seaborn")

plt.rcParams["font.size"] = 16

What is customer segmentation?#

Understand landscape of the market in businesses and craft targeted business or marketing strategies tailored for each group.

Check out this interesting talk by Malcom Gladwell. Humans are diverse and there is no single spaghetti sauce that would make all of them happy!

Often it’s beneficial to businesses to explore the landscape of the market and tailor their services and products offered to each group. This is called customer segmentation. It’s usually applied when the dataset contains some of the following features.

Demographic information such as gender, age, marital status, income, education, and occupation

Geographical information such as specific towns or counties or a customer’s city, state, or even country of residence (in case of big global companies)

Psychographics such as social class, lifestyle, and personality traits

Behavioral data such as spending and consumption habits, product/service usage, and desired benefits

Business problem#

Imagine that you are hired as a data scientist at a bank. They provide some data of their credit card customers to you.

Their goal is to develop customized marketing campaigns and they ask you to group customers based on the given information.

Now that you know about K-Means clustering, let’s apply it to the dataset to group customers.

Data#

We will use the Credit Card Dataset for clustering from Kaggle.

Download the data and save the CSV under the

datafolder.I encourage you to work through this case study on your own.

creditcard_df = pd.read_csv("data/CC General.csv")

creditcard_df.shape

(8950, 18)

Information of the dataset#

We have behavioral data.

CUSTID: Identification of Credit Card holder

BALANCE: Balance amount left in customer’s account to make purchases

BALANCE_FREQUENCY: How frequently the Balance is updated, score between 0 and 1 (1 = frequently updated, 0 = not frequently updated)

PURCHASES: Amount of purchases made from account

ONEOFFPURCHASES: Maximum purchase amount done in one-go

INSTALLMENTS_PURCHASES: Amount of purchase done in installment

CASH_ADVANCE: Cash in advance given by the user

PURCHASES_FREQUENCY: How frequently the Purchases are being made, score between 0 and 1 (1 = frequently purchased, 0 = not frequently purchased)

ONEOFF_PURCHASES_FREQUENCY: How frequently Purchases are happening in one-go (1 = frequently purchased, 0 = not frequently purchased)

PURCHASES_INSTALLMENTS_FREQUENCY: How frequently purchases in installments are being done (1 = frequently done, 0 = not frequently done)

CASH_ADVANCE_FREQUENCY: How frequently the cash in advance being paid

CASH_ADVANCE_TRX: Number of Transactions made with “Cash in Advance”

PURCHASES_TRX: Number of purchase transactions made

CREDIT_LIMIT: Limit of Credit Card for user

PAYMENTS: Amount of Payment done by user

MINIMUM_PAYMENTS: Minimum amount of payments made by user

PRC_FULL_PAYMENT: Percent of full payment paid by user

TENURE: Tenure of credit card service for user

Preliminary EDA#

creditcard_df.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 8950 entries, 0 to 8949

Data columns (total 18 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 CUST_ID 8950 non-null object

1 BALANCE 8950 non-null float64

2 BALANCE_FREQUENCY 8950 non-null float64

3 PURCHASES 8950 non-null float64

4 ONEOFF_PURCHASES 8950 non-null float64

5 INSTALLMENTS_PURCHASES 8950 non-null float64

6 CASH_ADVANCE 8950 non-null float64

7 PURCHASES_FREQUENCY 8950 non-null float64

8 ONEOFF_PURCHASES_FREQUENCY 8950 non-null float64

9 PURCHASES_INSTALLMENTS_FREQUENCY 8950 non-null float64

10 CASH_ADVANCE_FREQUENCY 8950 non-null float64

11 CASH_ADVANCE_TRX 8950 non-null int64

12 PURCHASES_TRX 8950 non-null int64

13 CREDIT_LIMIT 8949 non-null float64

14 PAYMENTS 8950 non-null float64

15 MINIMUM_PAYMENTS 8637 non-null float64

16 PRC_FULL_PAYMENT 8950 non-null float64

17 TENURE 8950 non-null int64

dtypes: float64(14), int64(3), object(1)

memory usage: 1.2+ MB

All numeric features

Some missing values

creditcard_df.describe()

| BALANCE | BALANCE_FREQUENCY | PURCHASES | ONEOFF_PURCHASES | INSTALLMENTS_PURCHASES | CASH_ADVANCE | PURCHASES_FREQUENCY | ONEOFF_PURCHASES_FREQUENCY | PURCHASES_INSTALLMENTS_FREQUENCY | CASH_ADVANCE_FREQUENCY | CASH_ADVANCE_TRX | PURCHASES_TRX | CREDIT_LIMIT | PAYMENTS | MINIMUM_PAYMENTS | PRC_FULL_PAYMENT | TENURE | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 8950.000000 | 8950.000000 | 8950.000000 | 8950.000000 | 8950.000000 | 8950.000000 | 8950.000000 | 8950.000000 | 8950.000000 | 8950.000000 | 8950.000000 | 8950.000000 | 8949.000000 | 8950.000000 | 8637.000000 | 8950.000000 | 8950.000000 |

| mean | 1564.474828 | 0.877271 | 1003.204834 | 592.437371 | 411.067645 | 978.871112 | 0.490351 | 0.202458 | 0.364437 | 0.135144 | 3.248827 | 14.709832 | 4494.449450 | 1733.143852 | 864.206542 | 0.153715 | 11.517318 |

| std | 2081.531879 | 0.236904 | 2136.634782 | 1659.887917 | 904.338115 | 2097.163877 | 0.401371 | 0.298336 | 0.397448 | 0.200121 | 6.824647 | 24.857649 | 3638.815725 | 2895.063757 | 2372.446607 | 0.292499 | 1.338331 |

| min | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 50.000000 | 0.000000 | 0.019163 | 0.000000 | 6.000000 |

| 25% | 128.281915 | 0.888889 | 39.635000 | 0.000000 | 0.000000 | 0.000000 | 0.083333 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 1.000000 | 1600.000000 | 383.276166 | 169.123707 | 0.000000 | 12.000000 |

| 50% | 873.385231 | 1.000000 | 361.280000 | 38.000000 | 89.000000 | 0.000000 | 0.500000 | 0.083333 | 0.166667 | 0.000000 | 0.000000 | 7.000000 | 3000.000000 | 856.901546 | 312.343947 | 0.000000 | 12.000000 |

| 75% | 2054.140036 | 1.000000 | 1110.130000 | 577.405000 | 468.637500 | 1113.821139 | 0.916667 | 0.300000 | 0.750000 | 0.222222 | 4.000000 | 17.000000 | 6500.000000 | 1901.134317 | 825.485459 | 0.142857 | 12.000000 |

| max | 19043.138560 | 1.000000 | 49039.570000 | 40761.250000 | 22500.000000 | 47137.211760 | 1.000000 | 1.000000 | 1.000000 | 1.500000 | 123.000000 | 358.000000 | 30000.000000 | 50721.483360 | 76406.207520 | 1.000000 | 12.000000 |

Practice exercises for you#

What is the average

BALANCEamount?How often the

BALANCE_FREQUENCYis updated on average?Obtain the row the customer who made the maximum cash advance transaction.

Mini exercises for you (Answers)#

What is the average

BALANCEamount? 1564.47How often the

BALANCE_FREQUENCYis updated on average? 0.877 (pretty often)Obtain the row of the customer who made the maximum cash advance transaction.

# Answer 3.

max_cash_advance = creditcard_df["CASH_ADVANCE"].max()

creditcard_df[creditcard_df["CASH_ADVANCE"] == max_cash_advance]

| CUST_ID | BALANCE | BALANCE_FREQUENCY | PURCHASES | ONEOFF_PURCHASES | INSTALLMENTS_PURCHASES | CASH_ADVANCE | PURCHASES_FREQUENCY | ONEOFF_PURCHASES_FREQUENCY | PURCHASES_INSTALLMENTS_FREQUENCY | CASH_ADVANCE_FREQUENCY | CASH_ADVANCE_TRX | PURCHASES_TRX | CREDIT_LIMIT | PAYMENTS | MINIMUM_PAYMENTS | PRC_FULL_PAYMENT | TENURE | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2159 | C12226 | 10905.05381 | 1.0 | 431.93 | 133.5 | 298.43 | 47137.21176 | 0.583333 | 0.25 | 0.5 | 1.0 | 123 | 21 | 19600.0 | 39048.59762 | 5394.173671 | 0.0 | 12 |

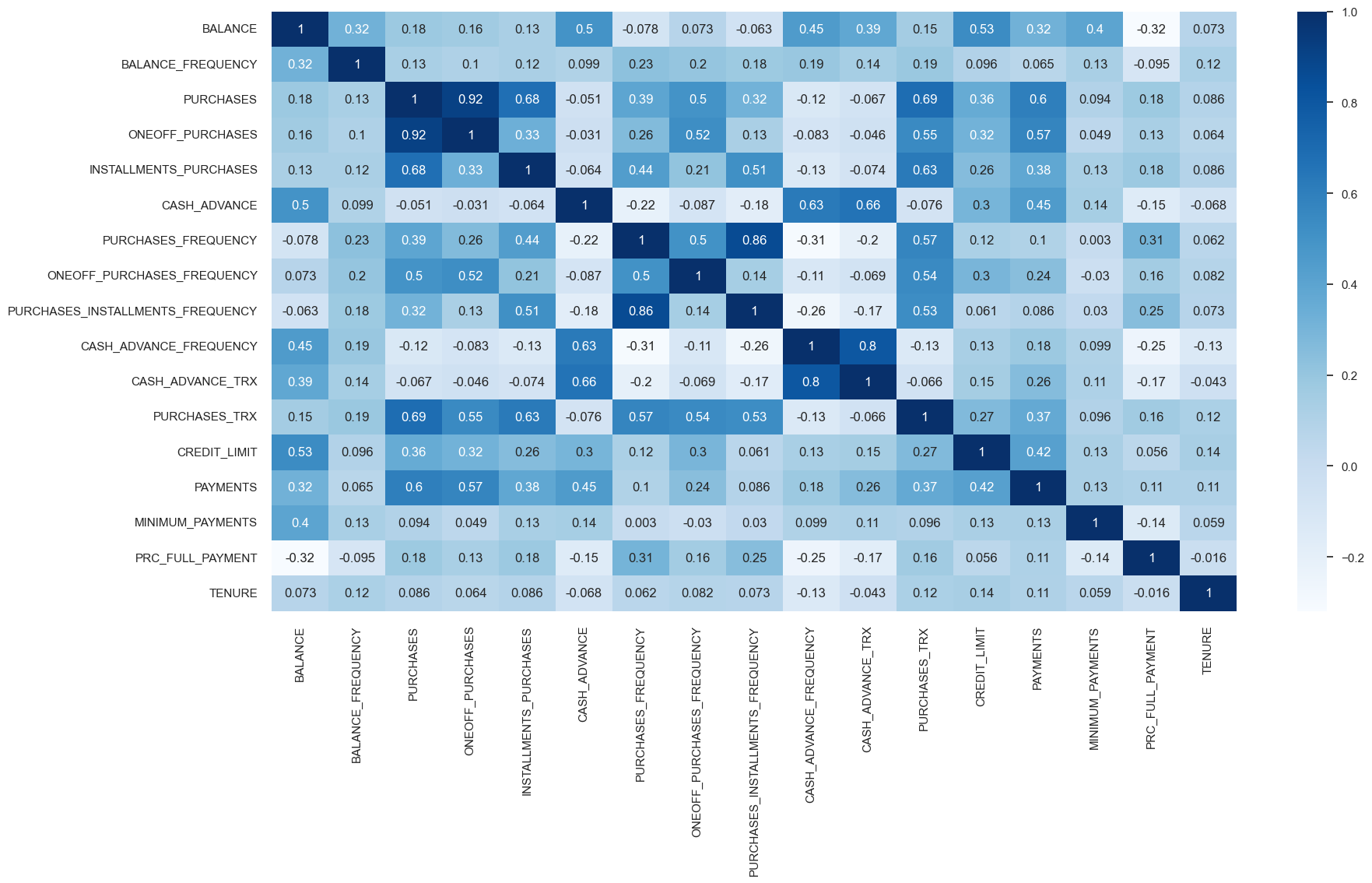

Let’s examine correlations between features.

cor = creditcard_df.corr()

plt.figure(figsize=(20, 10))

sns.set(font_scale=1)

sns.heatmap(cor, annot=True, cmap=plt.cm.Blues);

/var/folders/b3/g26r0dcx4b35vf3nk31216hc0000gr/T/ipykernel_6151/4232743610.py:1: FutureWarning: The default value of numeric_only in DataFrame.corr is deprecated. In a future version, it will default to False. Select only valid columns or specify the value of numeric_only to silence this warning.

cor = creditcard_df.corr()

corr_df = (creditcard_df.corr('spearman').round(2))

corr_df.style.background_gradient().set_precision(2)

/var/folders/b3/g26r0dcx4b35vf3nk31216hc0000gr/T/ipykernel_6151/2227010425.py:1: FutureWarning: The default value of numeric_only in DataFrame.corr is deprecated. In a future version, it will default to False. Select only valid columns or specify the value of numeric_only to silence this warning.

corr_df = (creditcard_df.corr('spearman').round(2))

/var/folders/b3/g26r0dcx4b35vf3nk31216hc0000gr/T/ipykernel_6151/2227010425.py:2: FutureWarning: this method is deprecated in favour of `Styler.format(precision=..)`

corr_df.style.background_gradient().set_precision(2)

| BALANCE | BALANCE_FREQUENCY | PURCHASES | ONEOFF_PURCHASES | INSTALLMENTS_PURCHASES | CASH_ADVANCE | PURCHASES_FREQUENCY | ONEOFF_PURCHASES_FREQUENCY | PURCHASES_INSTALLMENTS_FREQUENCY | CASH_ADVANCE_FREQUENCY | CASH_ADVANCE_TRX | PURCHASES_TRX | CREDIT_LIMIT | PAYMENTS | MINIMUM_PAYMENTS | PRC_FULL_PAYMENT | TENURE | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BALANCE | 1.00 | 0.54 | 0.01 | 0.15 | -0.09 | 0.57 | -0.15 | 0.12 | -0.14 | 0.54 | 0.55 | -0.05 | 0.37 | 0.43 | 0.90 | -0.48 | 0.07 |

| BALANCE_FREQUENCY | 0.54 | 1.00 | 0.15 | 0.13 | 0.13 | 0.14 | 0.20 | 0.16 | 0.15 | 0.18 | 0.18 | 0.20 | 0.11 | 0.21 | 0.50 | -0.17 | 0.23 |

| PURCHASES | 0.01 | 0.15 | 1.00 | 0.75 | 0.71 | -0.38 | 0.79 | 0.69 | 0.61 | -0.39 | -0.38 | 0.89 | 0.26 | 0.39 | -0.01 | 0.24 | 0.13 |

| ONEOFF_PURCHASES | 0.15 | 0.13 | 0.75 | 1.00 | 0.20 | -0.18 | 0.42 | 0.95 | 0.12 | -0.18 | -0.18 | 0.59 | 0.30 | 0.36 | 0.07 | 0.05 | 0.10 |

| INSTALLMENTS_PURCHASES | -0.09 | 0.13 | 0.71 | 0.20 | 1.00 | -0.36 | 0.79 | 0.19 | 0.92 | -0.37 | -0.36 | 0.78 | 0.12 | 0.24 | -0.05 | 0.28 | 0.12 |

| CASH_ADVANCE | 0.57 | 0.14 | -0.38 | -0.18 | -0.36 | 1.00 | -0.45 | -0.19 | -0.38 | 0.94 | 0.95 | -0.41 | 0.16 | 0.26 | 0.48 | -0.27 | -0.11 |

| PURCHASES_FREQUENCY | -0.15 | 0.20 | 0.79 | 0.42 | 0.79 | -0.45 | 1.00 | 0.46 | 0.85 | -0.45 | -0.45 | 0.92 | 0.10 | 0.17 | -0.10 | 0.29 | 0.10 |

| ONEOFF_PURCHASES_FREQUENCY | 0.12 | 0.16 | 0.69 | 0.95 | 0.19 | -0.19 | 0.46 | 1.00 | 0.11 | -0.18 | -0.17 | 0.61 | 0.28 | 0.32 | 0.05 | 0.06 | 0.08 |

| PURCHASES_INSTALLMENTS_FREQUENCY | -0.14 | 0.15 | 0.61 | 0.12 | 0.92 | -0.38 | 0.85 | 0.11 | 1.00 | -0.38 | -0.37 | 0.78 | 0.05 | 0.12 | -0.08 | 0.26 | 0.11 |

| CASH_ADVANCE_FREQUENCY | 0.54 | 0.18 | -0.39 | -0.18 | -0.37 | 0.94 | -0.45 | -0.18 | -0.38 | 1.00 | 0.98 | -0.41 | 0.09 | 0.20 | 0.46 | -0.29 | -0.13 |

| CASH_ADVANCE_TRX | 0.55 | 0.18 | -0.38 | -0.18 | -0.36 | 0.95 | -0.45 | -0.17 | -0.37 | 0.98 | 1.00 | -0.40 | 0.10 | 0.21 | 0.47 | -0.28 | -0.10 |

| PURCHASES_TRX | -0.05 | 0.20 | 0.89 | 0.59 | 0.78 | -0.41 | 0.92 | 0.61 | 0.78 | -0.41 | -0.40 | 1.00 | 0.19 | 0.28 | -0.03 | 0.25 | 0.17 |

| CREDIT_LIMIT | 0.37 | 0.11 | 0.26 | 0.30 | 0.12 | 0.16 | 0.10 | 0.28 | 0.05 | 0.09 | 0.10 | 0.19 | 1.00 | 0.45 | 0.26 | 0.02 | 0.17 |

| PAYMENTS | 0.43 | 0.21 | 0.39 | 0.36 | 0.24 | 0.26 | 0.17 | 0.32 | 0.12 | 0.20 | 0.21 | 0.28 | 0.45 | 1.00 | 0.37 | 0.19 | 0.21 |

| MINIMUM_PAYMENTS | 0.90 | 0.50 | -0.01 | 0.07 | -0.05 | 0.48 | -0.10 | 0.05 | -0.08 | 0.46 | 0.47 | -0.03 | 0.26 | 0.37 | 1.00 | -0.48 | 0.14 |

| PRC_FULL_PAYMENT | -0.48 | -0.17 | 0.24 | 0.05 | 0.28 | -0.27 | 0.29 | 0.06 | 0.26 | -0.29 | -0.28 | 0.25 | 0.02 | 0.19 | -0.48 | 1.00 | 0.02 |

| TENURE | 0.07 | 0.23 | 0.13 | 0.10 | 0.12 | -0.11 | 0.10 | 0.08 | 0.11 | -0.13 | -0.10 | 0.17 | 0.17 | 0.21 | 0.14 | 0.02 | 1.00 |

Feature types and preprocessing#

Let’s identify different feature types and transformations

creditcard_df.columns

Index(['CUST_ID', 'BALANCE', 'BALANCE_FREQUENCY', 'PURCHASES',

'ONEOFF_PURCHASES', 'INSTALLMENTS_PURCHASES', 'CASH_ADVANCE',

'PURCHASES_FREQUENCY', 'ONEOFF_PURCHASES_FREQUENCY',

'PURCHASES_INSTALLMENTS_FREQUENCY', 'CASH_ADVANCE_FREQUENCY',

'CASH_ADVANCE_TRX', 'PURCHASES_TRX', 'CREDIT_LIMIT', 'PAYMENTS',

'MINIMUM_PAYMENTS', 'PRC_FULL_PAYMENT', 'TENURE'],

dtype='object')

drop_features = ["CUST_ID"]

numeric_features = list(set(creditcard_df.columns) - set(drop_features))

from sklearn.impute import SimpleImputer

numeric_transformer = make_pipeline(SimpleImputer(), StandardScaler())

preprocessor = make_column_transformer(

(numeric_transformer, numeric_features), ("drop", drop_features)

)

transformed_df = pd.DataFrame(

data=preprocessor.fit_transform(creditcard_df), columns=numeric_features

)

transformed_df

| CASH_ADVANCE | PURCHASES | INSTALLMENTS_PURCHASES | BALANCE | PURCHASES_FREQUENCY | PRC_FULL_PAYMENT | TENURE | ONEOFF_PURCHASES | ONEOFF_PURCHASES_FREQUENCY | PURCHASES_TRX | CREDIT_LIMIT | PAYMENTS | MINIMUM_PAYMENTS | BALANCE_FREQUENCY | CASH_ADVANCE_TRX | PURCHASES_INSTALLMENTS_FREQUENCY | CASH_ADVANCE_FREQUENCY | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | -0.466786 | -0.424900 | -0.349079 | -0.731989 | -0.806490 | -0.525551 | 0.360680 | -0.356934 | -0.678661 | -0.511333 | -0.960433 | -0.528979 | -3.109675e-01 | -0.249434 | -0.476070 | -0.707313 | -0.675349 |

| 1 | 2.605605 | -0.469552 | -0.454576 | 0.786961 | -1.221758 | 0.234227 | 0.360680 | -0.356934 | -0.678661 | -0.591796 | 0.688639 | 0.818642 | 8.931021e-02 | 0.134325 | 0.110074 | -0.916995 | 0.573963 |

| 2 | -0.466786 | -0.107668 | -0.454576 | 0.447135 | 1.269843 | -0.525551 | 0.360680 | 0.108889 | 2.673451 | -0.109020 | 0.826062 | -0.383805 | -1.016632e-01 | 0.518084 | -0.476070 | -0.916995 | -0.675349 |

| 3 | -0.368653 | 0.232058 | -0.454576 | 0.049099 | -1.014125 | -0.525551 | 0.360680 | 0.546189 | -0.399319 | -0.551565 | 0.826062 | -0.598688 | 4.878305e-17 | -1.016953 | -0.329534 | -0.916995 | -0.258913 |

| 4 | -0.466786 | -0.462063 | -0.454576 | -0.358775 | -1.014125 | -0.525551 | 0.360680 | -0.347294 | -0.399319 | -0.551565 | -0.905464 | -0.364368 | -2.657913e-01 | 0.518084 | -0.476070 | -0.916995 | -0.675349 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 8945 | -0.466786 | -0.333293 | -0.132643 | -0.737950 | 1.269843 | 1.183951 | -4.122768 | -0.356934 | -0.678661 | -0.350408 | -0.960433 | -0.486217 | -3.498541e-01 | 0.518084 | -0.476070 | 1.179833 | -0.675349 |

| 8946 | -0.466786 | -0.329136 | -0.122823 | -0.742423 | 1.269843 | -0.525551 | -4.122768 | -0.356934 | -0.678661 | -0.350408 | -0.960433 | -0.503396 | 4.878305e-17 | 0.518084 | -0.476070 | 1.179833 | -0.675349 |

| 8947 | -0.466786 | -0.401965 | -0.294893 | -0.740398 | 0.854576 | 0.329200 | -4.122768 | -0.356934 | -0.678661 | -0.390639 | -0.960433 | -0.570615 | -3.354655e-01 | -0.185477 | -0.476070 | 0.760469 | -0.675349 |

| 8948 | -0.449352 | -0.469552 | -0.454576 | -0.745174 | -1.221758 | 0.329200 | -4.122768 | -0.356934 | -0.678661 | -0.591796 | -1.097856 | -0.580536 | -3.469065e-01 | -0.185477 | -0.182998 | -0.916995 | 0.157527 |

| 8949 | -0.406205 | 0.042146 | -0.454576 | -0.572575 | 0.439310 | -0.525551 | -4.122768 | 0.301732 | 1.556082 | 0.333524 | -0.905464 | -0.576869 | -3.329464e-01 | -0.889033 | -0.182998 | -0.916995 | 0.990398 |

8950 rows × 17 columns

Now that we have transformed the data, we are ready to run K-Means to cluster credit card customers.

Choosing n_clusters#

There is no definitive method to find the optimal number of clusters.

Let’s try different approaches.

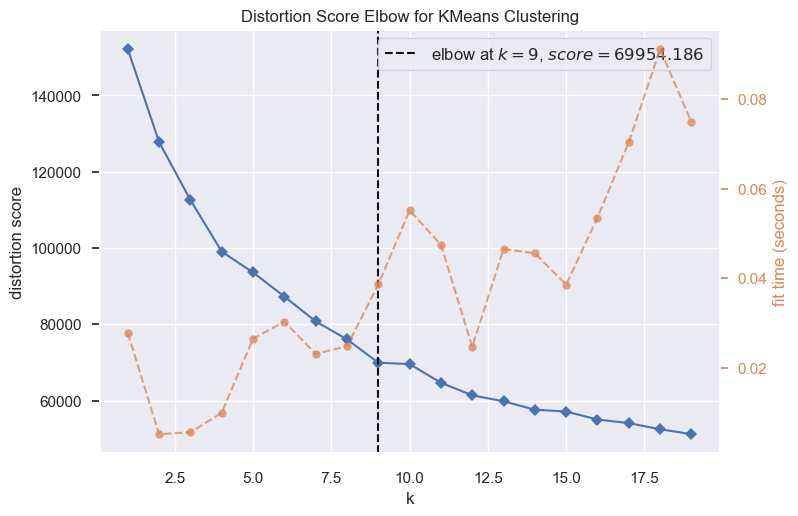

The Elbow method#

model = KMeans(random_state=42, n_init='auto')

visualizer = KElbowVisualizer(model, k=(1, 20))

visualizer.fit(transformed_df) # Fit the data to the visualizer

visualizer.show();

The optimal number of clusters is not as clear as it was in our toy example.

Let’s examine Silhouette scores.

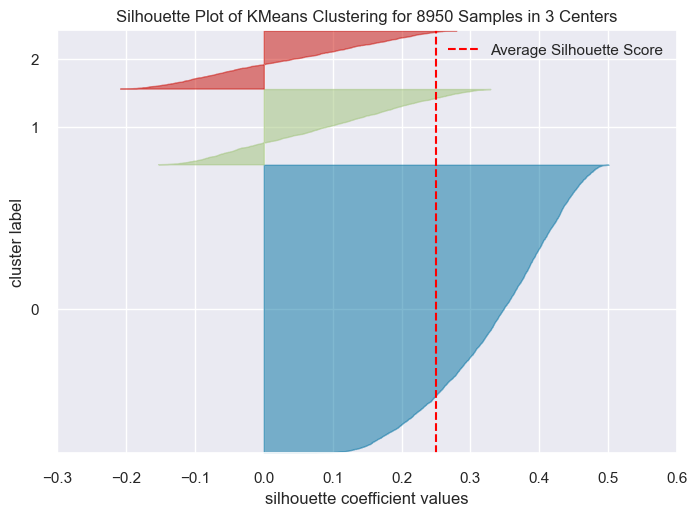

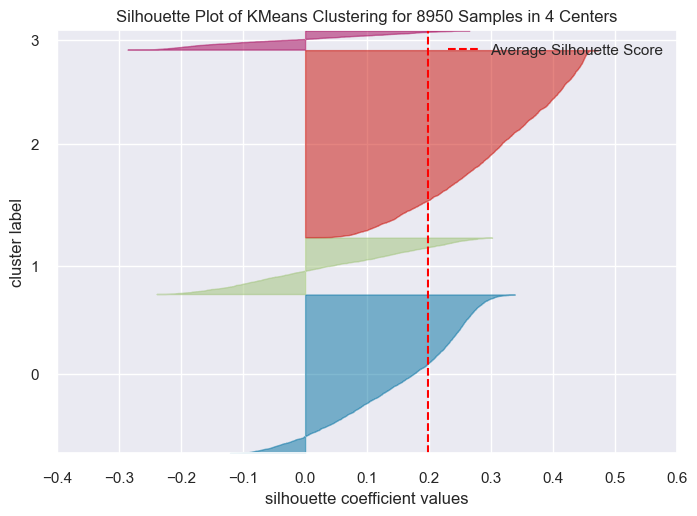

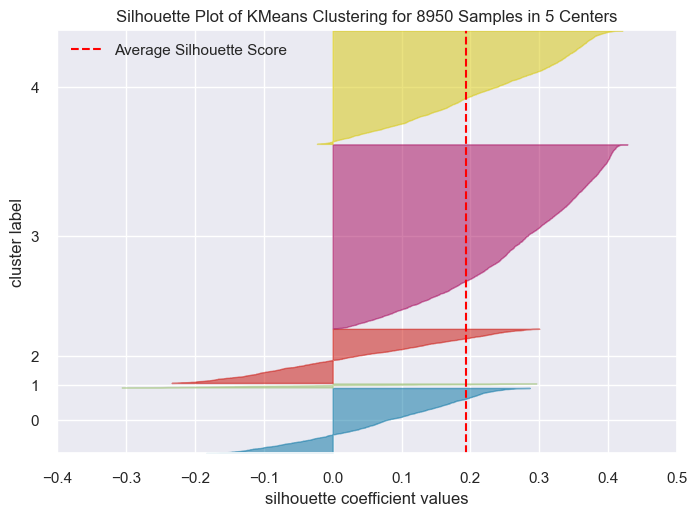

for k in range(3, 6):

model = KMeans(k, random_state=42)

visualizer = SilhouetteVisualizer(model, colors="yellowbrick")

visualizer.fit(transformed_df) # Fit the data to the visualizer

visualizer.show()

/Users/kvarada/opt/miniconda3/envs/563/lib/python3.10/site-packages/sklearn/cluster/_kmeans.py:870: FutureWarning: The default value of `n_init` will change from 10 to 'auto' in 1.4. Set the value of `n_init` explicitly to suppress the warning

warnings.warn(

/Users/kvarada/opt/miniconda3/envs/563/lib/python3.10/site-packages/sklearn/cluster/_kmeans.py:870: FutureWarning: The default value of `n_init` will change from 10 to 'auto' in 1.4. Set the value of `n_init` explicitly to suppress the warning

warnings.warn(

/Users/kvarada/opt/miniconda3/envs/563/lib/python3.10/site-packages/sklearn/cluster/_kmeans.py:870: FutureWarning: The default value of `n_init` will change from 10 to 'auto' in 1.4. Set the value of `n_init` explicitly to suppress the warning

warnings.warn(

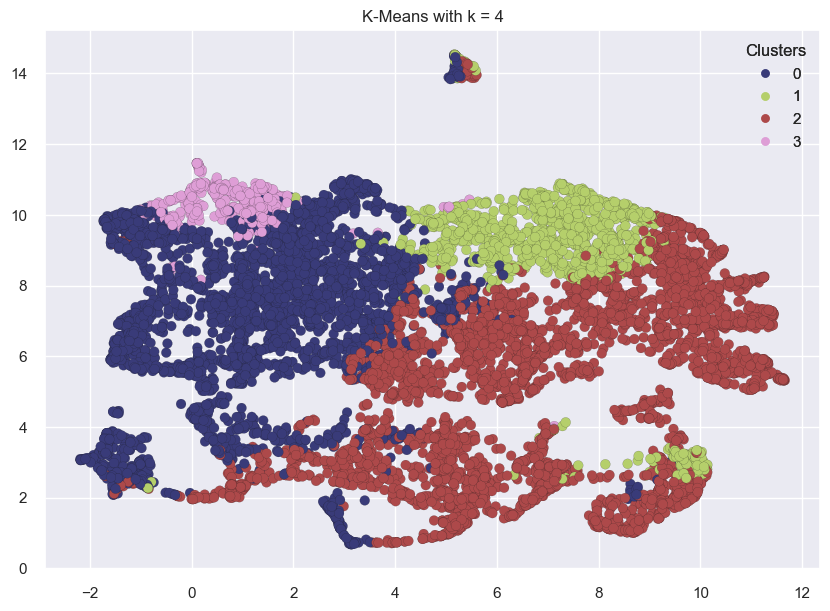

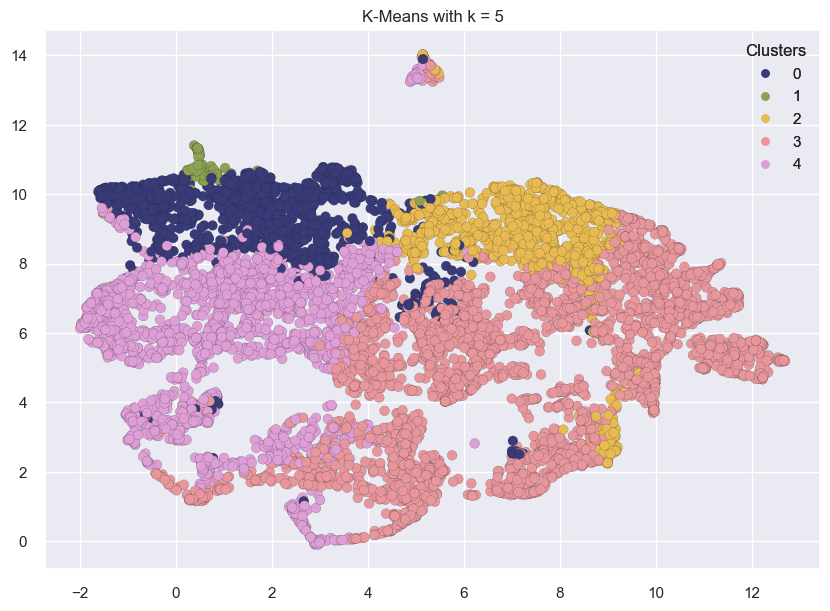

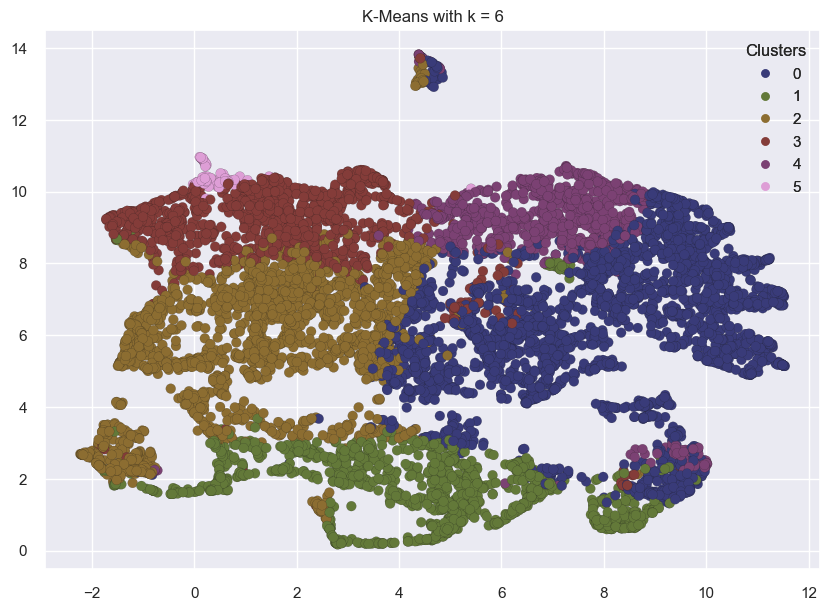

I’m going to run

KMeanswithn_clusters = 4.You can try out

n_clusters = 5andn_clusters = 6on your own.

Visualizing clusters#

Can we visualize the clusters?

We have a high dimensional data and we need to reduce the dimensionality in order to visualize it.

Let’s reduce the dimensionality using a technique called UMAP.

I forgot to put this package in the course environment file. So to run the code below, you’ll have to install the umap-learn package in the course conda environment either with conda or pip, as described in the documentation.

> conda activate 563

> conda install -c conda-forge umap-learn

or

> conda activate 563

> pip install umap-learn

import umap

def plot_umap_clusters(

data,

cluster_labels,

size=50,

n_neighbors=15,

title="UMAP visualization",

):

"""

Carry out dimensionality reduction using UMAP and plot 2-dimensional clusters.

Parameters

-----------

data : numpy array

data as a numpy array

cluster_labels : list

cluster labels for each row in the dataset

size : int

size of points in the scatterplot

n_neighbors : int

n_neighbors hyperparameter of UMAP. See the documentation.

title : str

title for the visualization plot

Returns

-----------

None. Shows the clusters.

"""

reducer = umap.UMAP(n_neighbors=n_neighbors)

Z = reducer.fit_transform(data) # reduce dimensionality

umap_df = pd.DataFrame(data=Z, columns=["dim1", "dim2"])

umap_df["cluster"] = cluster_labels

labels = np.unique(umap_df["cluster"])

fig, ax = plt.subplots(figsize=(10, 7))

ax.set_title(title)

scatter = ax.scatter(

umap_df["dim1"],

umap_df["dim2"],

c=umap_df["cluster"],

cmap="tab20b",

s=size,

edgecolors="k",

linewidths=0.1,

)

legend = ax.legend(*scatter.legend_elements(), loc="best", title="Clusters")

ax.add_artist(legend)

plt.show()

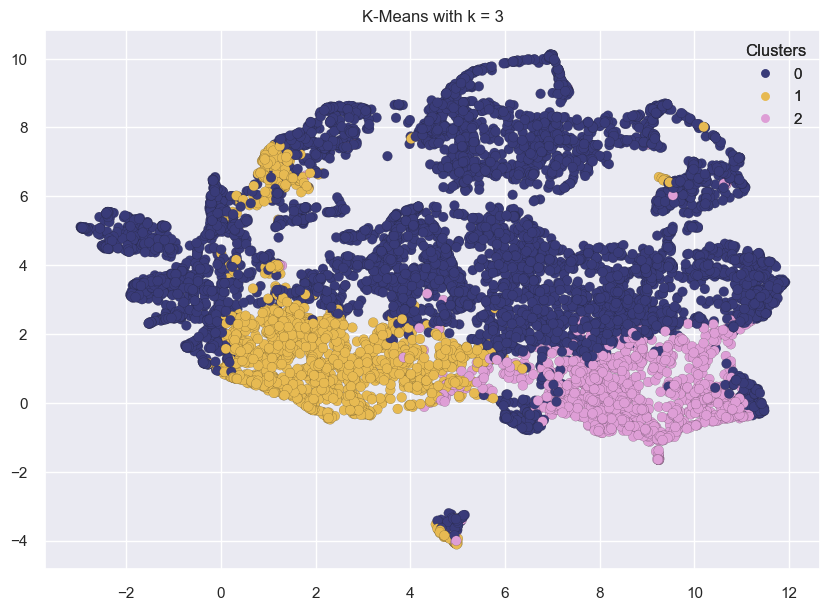

for k in range(3, 7):

kmeans = KMeans(n_clusters=k, random_state=42)

kmeans.fit(transformed_df)

labels = kmeans.labels_

plot_umap_clusters(transformed_df, kmeans.labels_, title=f"K-Means with k = {k}")

/Users/kvarada/opt/miniconda3/envs/563/lib/python3.10/site-packages/sklearn/cluster/_kmeans.py:870: FutureWarning: The default value of `n_init` will change from 10 to 'auto' in 1.4. Set the value of `n_init` explicitly to suppress the warning

warnings.warn(

/Users/kvarada/opt/miniconda3/envs/563/lib/python3.10/site-packages/sklearn/cluster/_kmeans.py:870: FutureWarning: The default value of `n_init` will change from 10 to 'auto' in 1.4. Set the value of `n_init` explicitly to suppress the warning

warnings.warn(

/Users/kvarada/opt/miniconda3/envs/563/lib/python3.10/site-packages/sklearn/cluster/_kmeans.py:870: FutureWarning: The default value of `n_init` will change from 10 to 'auto' in 1.4. Set the value of `n_init` explicitly to suppress the warning

warnings.warn(

/Users/kvarada/opt/miniconda3/envs/563/lib/python3.10/site-packages/sklearn/cluster/_kmeans.py:870: FutureWarning: The default value of `n_init` will change from 10 to 'auto' in 1.4. Set the value of `n_init` explicitly to suppress the warning

warnings.warn(

The clusters above look reasonably well separated.

This might not always be the case.

Cluster interpretation#

Let’s examine the cluster centers for k=4 and identify types of customers.

reasonable_k = 4

kmeans = KMeans(n_clusters=reasonable_k, random_state=42)

kmeans.fit(transformed_df)

labels = kmeans.labels_

/Users/kvarada/opt/miniconda3/envs/563/lib/python3.10/site-packages/sklearn/cluster/_kmeans.py:870: FutureWarning: The default value of `n_init` will change from 10 to 'auto' in 1.4. Set the value of `n_init` explicitly to suppress the warning

warnings.warn(

cluster_centers = pd.DataFrame(

data=kmeans.cluster_centers_, columns=[transformed_df.columns]

)

cluster_centers

| CASH_ADVANCE | PURCHASES | INSTALLMENTS_PURCHASES | BALANCE | PURCHASES_FREQUENCY | PRC_FULL_PAYMENT | TENURE | ONEOFF_PURCHASES | ONEOFF_PURCHASES_FREQUENCY | PURCHASES_TRX | CREDIT_LIMIT | PAYMENTS | MINIMUM_PAYMENTS | BALANCE_FREQUENCY | CASH_ADVANCE_TRX | PURCHASES_INSTALLMENTS_FREQUENCY | CASH_ADVANCE_FREQUENCY | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | -0.366373 | 0.109044 | 0.255904 | -0.321688 | 0.983721 | 0.395041 | 0.057744 | 0.000926 | 0.317153 | 0.296985 | -0.077298 | -0.138502 | -0.091844 | 0.242574 | -0.360303 | 0.874138 | -0.462599 |

| 1 | 1.688972 | -0.234638 | -0.253747 | 1.459578 | -0.504848 | -0.406367 | -0.097146 | -0.163914 | -0.212939 | -0.283580 | 0.838968 | 0.603821 | 0.490910 | 0.384753 | 1.617143 | -0.450201 | 1.745948 |

| 2 | -0.182691 | -0.343190 | -0.387798 | -0.265552 | -0.797823 | -0.258866 | -0.052972 | -0.230500 | -0.389437 | -0.474987 | -0.334417 | -0.262060 | -0.119249 | -0.368944 | -0.164607 | -0.714246 | -0.101500 |

| 3 | -0.155091 | 3.125845 | 2.406470 | 0.954485 | 1.136338 | 0.454703 | 0.324140 | 2.713251 | 1.798653 | 3.003251 | 1.429882 | 1.919096 | 0.477421 | 0.462694 | -0.170458 | 1.065918 | -0.319096 |

Recall that we have applied imputation and scaling on the dataset.

But we would be able to interpret these clusters better if the centers are in the original scale.

So let’s apply inverse transformations to get the cluster center values in the original scale.

data = (

preprocessor.named_transformers_["pipeline"]

.named_steps["standardscaler"]

.inverse_transform(cluster_centers[numeric_features])

)

org_cluster_centers = pd.DataFrame(data=data, columns=numeric_features)

org_cluster_centers = org_cluster_centers.reindex(

sorted(org_cluster_centers.columns), axis=1

)

org_cluster_centers

| BALANCE | BALANCE_FREQUENCY | CASH_ADVANCE | CASH_ADVANCE_FREQUENCY | CASH_ADVANCE_TRX | CREDIT_LIMIT | INSTALLMENTS_PURCHASES | MINIMUM_PAYMENTS | ONEOFF_PURCHASES | ONEOFF_PURCHASES_FREQUENCY | PAYMENTS | PRC_FULL_PAYMENT | PURCHASES | PURCHASES_FREQUENCY | PURCHASES_INSTALLMENTS_FREQUENCY | PURCHASES_TRX | TENURE | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 894.907458 | 0.934734 | 210.570626 | 0.042573 | 0.790021 | 4213.207678 | 642.478274 | 650.167072 | 593.974874 | 0.297070 | 1332.194205 | 0.269258 | 1236.178934 | 0.885165 | 0.711842 | 22.091773 | 11.594595 |

| 1 | 4602.462714 | 0.968415 | 4520.724309 | 0.484526 | 14.284641 | 7546.957050 | 181.607404 | 2008.251157 | 320.373681 | 0.138934 | 3481.145990 | 0.034859 | 501.896219 | 0.287731 | 0.185516 | 7.661102 | 11.387312 |

| 2 | 1011.751528 | 0.789871 | 595.759339 | 0.114833 | 2.125503 | 3277.703165 | 60.386625 | 586.301239 | 209.853863 | 0.086281 | 974.505090 | 0.078001 | 269.973466 | 0.170146 | 0.080578 | 2.903421 | 11.446429 |

| 3 | 3551.153761 | 0.986879 | 653.638891 | 0.071290 | 2.085575 | 9696.943765 | 2587.208264 | 1976.815179 | 5095.878826 | 0.739031 | 7288.739497 | 0.286707 | 7681.620098 | 0.946418 | 0.788060 | 89.359413 | 11.951100 |

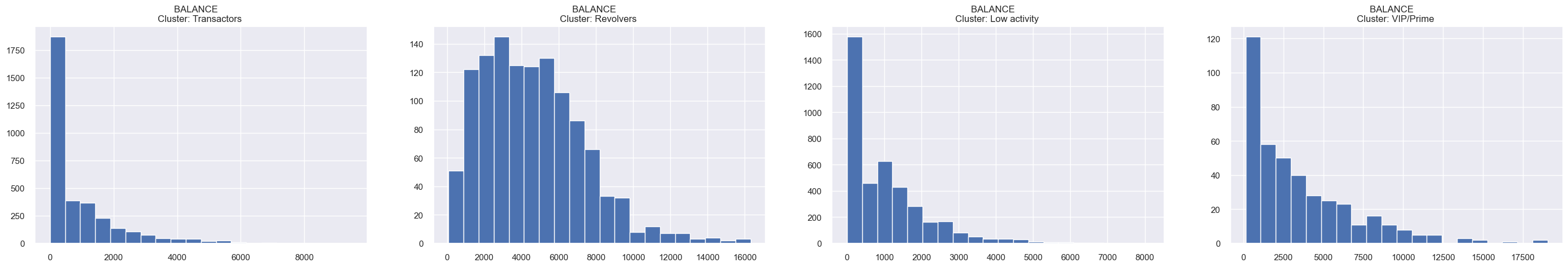

cluster_labels = {0: "Transactors", 1: "Revolvers", 2: "Low activity", 3: "VIP/Prime"}

org_cluster_centers["cluster_labels"] = list(cluster_labels.values())

relevant_cols = [

"cluster_labels",

"BALANCE",

"CREDIT_LIMIT",

"PRC_FULL_PAYMENT",

"PURCHASES_FREQUENCY",

"CASH_ADVANCE",

"CASH_ADVANCE_FREQUENCY",

"CASH_ADVANCE_TRX",

]

org_cluster_centers[relevant_cols]

| cluster_labels | BALANCE | CREDIT_LIMIT | PRC_FULL_PAYMENT | PURCHASES_FREQUENCY | CASH_ADVANCE | CASH_ADVANCE_FREQUENCY | CASH_ADVANCE_TRX | |

|---|---|---|---|---|---|---|---|---|

| 0 | Transactors | 894.907458 | 4213.207678 | 0.269258 | 0.885165 | 210.570626 | 0.042573 | 0.790021 |

| 1 | Revolvers | 4602.462714 | 7546.957050 | 0.034859 | 0.287731 | 4520.724309 | 0.484526 | 14.284641 |

| 2 | Low activity | 1011.751528 | 3277.703165 | 0.078001 | 0.170146 | 595.759339 | 0.114833 | 2.125503 |

| 3 | VIP/Prime | 3551.153761 | 9696.943765 | 0.286707 | 0.946418 | 653.638891 | 0.071290 | 2.085575 |

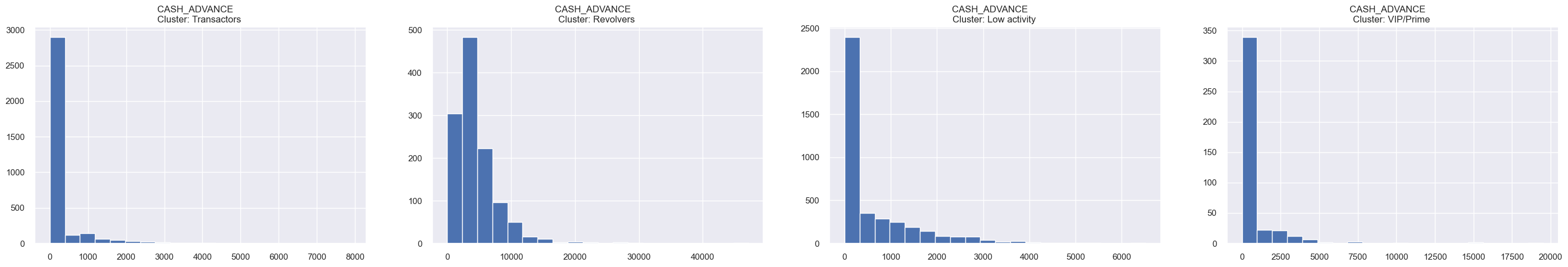

One way to interpret and label the clusters above is as follows.

Transactors#

Credit card users who pay off their balance every month with least amount of interest charges.

They are careful with their money.

They have lowest balance and cash advance

Revolvers#

Credit card users who pay off only part of their monthly balance. They use credit card as a loan.

They have highest balance and cash advance, high cash advance frequency, low purchase frequency, high cash advance transactions, low percentage of full payment

Their credit limit is also high. (Lucrative group for banks 😟.)

Low activity#

There is not much activity in the account. It has low balance and not many purchases.

Credit card users who have low credit limit.

VIP/Prime#

Credit card users who have high credit limit.

They have high one-off purchases frequency, high number of purchase transactions.

They have high balance but they also have higher percentage of full payment, similar to transactors

Target for increase credit limit (and increase spending habits)

More on interpretation of clusters#

In real life, you’ll look through all features in detail before assigning meaning to clusters.

This is not that easy, especially when you have a large number of features and clusters.

One way to approach this would be visualizing the distribution of feature values for each cluster.

Some domain knowledge would definitely help at this stage.

creditcard_df['cluster'] = labels

Let’s check the cluster assignment for the customer who made the maximum cash advance transaction.

creditcard_df[creditcard_df["CASH_ADVANCE"] == max_cash_advance]

| CUST_ID | BALANCE | BALANCE_FREQUENCY | PURCHASES | ONEOFF_PURCHASES | INSTALLMENTS_PURCHASES | CASH_ADVANCE | PURCHASES_FREQUENCY | ONEOFF_PURCHASES_FREQUENCY | PURCHASES_INSTALLMENTS_FREQUENCY | CASH_ADVANCE_FREQUENCY | CASH_ADVANCE_TRX | PURCHASES_TRX | CREDIT_LIMIT | PAYMENTS | MINIMUM_PAYMENTS | PRC_FULL_PAYMENT | TENURE | cluster | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2159 | C12226 | 10905.05381 | 1.0 | 431.93 | 133.5 | 298.43 | 47137.21176 | 0.583333 | 0.25 | 0.5 | 1.0 | 123 | 21 | 19600.0 | 39048.59762 | 5394.173671 | 0.0 | 12 | 1 |

def show_hists(df=creditcard_df, cols=["BALANCE", "CASH_ADVANCE"]):

for i in cols:

plt.figure(figsize=(35, 5))

for j in range(4):

plt.subplot(1, 4, j + 1)

cluster = df[df["cluster"] == j]

cluster[i].hist(bins=20)

plt.title(f"{i} \nCluster: {cluster_labels[j]} ")

plt.show()

show_hists() # Examining clusters for two features.

# Uncomment the code below to show histograms for all features.

# cols = creditcard_df_cluster.columns.to_list()

# cols.remove('CUST_ID')

# cols.remove('cluster')

# show_hists(creditcard_df_cluster, cols)

Practice exercise for you#

Try out different values for

n_clustersinKMeansand examine the clusters.If you are feeling adventurous, you may try customer segmentation on All Lending Club loan data.